Definitive Guide to Understanding Stocks and Stock Market in Papua New Guinea

Getting started

Today, many people in PNG are coming to realize the importance of saving for future. More and more people are realizing that cost of living is very high because of inflation and the one way to cushion their money from harsh impacts of inflation is to invest in revenue generating assets such as shares.

If you've never invested in company shares in the stock market before or you've acquired a few shares from an inheritance, your employment or an IPO and don’t really know how to manage them properly then this book is all you need to get started. As you get into the game and get to feel the vibration of the financial market, you may be motivated to learn more and get deeper into stock market.

I learnt that to succeed as an investor, there are a number of key steps you need to take, in the right sequence, at the very outset. If you avoid them in an attempt to save time and money, it will actually cost you more time and money as you meander aimlessly, acquiring knowledge you don’t need, becoming overloaded and confused and doing nothing as a result. Not a smart thing to do!

Why invest?

Let’s imagine a life without investing first. You work 9 am-5pm every day for a boss all your life, maybe get a couple of raises, a promotion, have a nice house, car, and kids. You go on vacation once a year, eat out regularly, and attempt to enjoy the finer things in life as best you can.

Now since you haven’t invested, you get old, become unattractive for hiring and that is the time life becomes hard. Many Papua New Guineans who come to towns and cities in search for education and job don’t often return home to their villages after retirement. If you are reading this book, chances are that your parents raised you in a city or you came to city in search for education and a better life. Living in city after retirement is very expensive. For that, you need to invest your money while you are working now so that by the time you retire, you would have enough assets to continue to generate you cash flow so you to lead a comfortable life after retirement.

However, I must warn you that investing is not for everyone. That is not to discourage you but to caution you to take necessary steps to get properly educated and do what is right.

Why invest? There are many reasons for investing your money but I picked three which I think are worth mentioning here.

- Cushion your money from inflation

- Grow wealth overtime-Compounding impact

- Lead quality life- Live your dream (s)

Inflation

Inflation is a silent invisible dinosaur that is eating away your money. It is always around and we know it but most pretend that it doesn’t exist. The only way to cushion your money from this invisible dinosaur is to invest your money in revenue generating assets. You can keep your money in the bank account. However, keeping your money in the banks is the best way to allow the dinosaur to eat away your money. What is this dinosaur I am talking about? The dinosaur as introduced earlier in this paragraph is the inflation.

Inflation is the sustained increase in the general price level of goods and services in an economy over a period of time. Inflation reduces purchase power of a currency. As a result your money buys less of goods and service and life becomes financially stressful.

I will give you a classic example. Just few years back, one packet of Lae Biscuit use to sell at 70t. Now price of that same packet has gone up to k1 or even more. You can think of all other goods and service in PNG and how their prices have increased like crazy over a very short period of time. This is inflation I am talking about. I will give you another example. Some years back, a packet of Lae Biscuit sold for 50 toea. If you went to a store with K2, you would have bought 4 packets of Lae Biscuit. Today the same packet goes for K2. So if you go to store today, instead of getting 4 packets, you will only get 1packet. That is what I mean when I say the buying power of money decreases because of inflation.

Take another example. Say you want to buy a house for K200, 000 at current price in five years. You are saving your money in the bank. By the time you have saved enough money to buy off that property in 5 years, the price of the house would have doubled to K400, 000. What happened? Off course the inflation blasted the price of the house forward yet, keeping your savings from keeping phase with the price of the property.

Read full article on compounding impact

- Using Power of Compounding Interest to Grow Your Wea...

The magical powers of compounding interest if used properly can multiply your wealth fast

Compounding impact

Compounding impact has been described by Albert Einstein as the eighth wonder of the world. It simply means reinvesting your return on investment to keep your money growing.

Let’s assume you bought 1000 shares in BSP. As the shareholder, you are entitled to BSP dividends if the company directors decide to pay its shareholders dividend. To compound your money, every time you receive dividend, you use that dividend to pay more shares. Not only in shares. You can do this to just about any revenue generating assets like mutual funds, bonds, property or business.

Related hubs

- Using the Leverage of Network to Build Wealth

Learn how the rich and powerful use the power of the leverage of network to amass greater wealth. - The 6 Irrefutable Habits That Separates the Winners ...

What makes Donald Trump come out a winner every time in one of the riches countries in the world where big players play in the business and investment playing field? Here are 6 habits of Donald Trump

Unique lifestyle

You were not put on earth to work, pay bills, retire on a meagre savings and die broke. What a lousy life as late Dr Myles Munroe once stated. You were born to do greater things in life. To live a life unique to yourself. A life you desire. A life of abundance and joy. See, I can’t tell you enough how powerful you are because exhaustive research shows us that man is the superior race on earth. Sometimes you don’t even need research data to prove this statement to be true. You are capable of doing just about anything you set your mind on. You just have to discover what is holding you back and kicked that thing holding you back and spring to life. I am taking about life in its fullness; of finer things in life, exotic vacations, fine food and clothes and more.

But before you have those finer things in life, let me be honest that you need money. Some may argue that money is not important. I would agree with them if I went back to Stone Age and live like my ancestors. In this day and age, money is everything. You need money to pay water and power bills, house rent, food and clothes, school fee for your children, transport to and fro work and you need money for social activities like sports or weekend party and even customary obligation.

You may ask “So how do I invest when I don’t even have enough money to start with?”

What I am about to tell you will surprise you. If you use the strategies I give you, you can have spare cash available for investment and if you stay investment long enough, you grow your wealth and lead the unique lifestyle you dream of. These strategies will help you protect your money from inflation and allow it to compound.

You don’t want your investment process to be a financially stressful experience. You should rather be having fun seeing your money grow as the impact of compounding interest sets in.

“How is that possible?” You should invest with money that you don’t need today, tomorrow, this week or next fortnight or even don’t need it at all. What I mean is that you must have some money apart from your everyday needed cash. I call this spare cash. And you must generate spare cash to invest. I will show you why it is not wise to invest the money you will need immediately. Wherever you see investment products and services or whenever you talk to anyone in the financial services industry about the stock market, you will come across a phrase like

"Never invest money that you can’t afford to lose"

To free up this spare cash, involves doing the following three things before you start investing:

1) Cut spending to much less than you earn – stop wasting money on stuff you don’t need and start putting that money to better use.

2) Clear short-term debts – use your free cash to clear overdrafts, credit cards, store cards, loans, etc. (but there’s no need to pay off your mortgage first).

3) Create an emergency fund – to cover any unexpected, short-term needs such as repairs, broken appliances, losing your job, etc.

When you’ve done this and have money left over…great...time to start investing! Before you jump in, let me give you a simple blueprint of stock market success that I myself adopted from stock market guru, Warren Buffet.

Related wealth creation hubs

- Using leverage of knowledge to grow wealth

Uncover the secrets behind how the rich and powerful use simple basic everyday knowledge to amass greater wealth while majority look for complicated investment information and end up losing more. - Financial Literacy and Mindset Training-Evidence and...

Understanding your mind, the values your possess and how you attract wealth to your life is something that occurs at at the deepest level of human mind. Here we seek to understand how the process work, taking Papua New Guinea as the case. - How To Grow Your Money Like The Rich People Do

The rich think in a certain way that makes them rich. The poor also think in a certain way that makes them poor.

What does this mean? Well, first off, it doesn’t mean that you will lose your money when you invest in the stock market. What it does mean is that, unlike ordinary bank savings for which your money rises slowly over time (ignoring inflation), the value of your company shares will constantly change in value up and down. Hence, depending on when you buy and sell, it is possible to lose some of your money.

In extreme cases, it is possible to lose all of your money. But for this to happen, you will need to have a very small number of shares in your portfolio, be very unlucky, and/or be participating in day trading activities which are not actually investing (e.g. spread betting, futures, contracts for difference, short-selling, etc, which are beyond the scope of this book).

Suffice it to say that if you stick to long-term, buy and hold investing, trade sparingly and build a portfolio containing at least 10 different companies in different business sectors, you should make a healthy investment return over 10 years plus.

Personally, I prefer the phrase: “Spare cash that you don’t need for anything else.”

Wealth creation blue print

People who have become successful in life often have what I call their success blue print. It simply is a way of thinking that guides them through thick and thin. I have adopted my wealth creation blue print from stock market guru and billionaire Warren Buffet. A complete account of this wealth creation blue print can be found in the book Snowball-Warren Buffet and Business of Life by Alice Schroeder.

This success blue print or strategy has been proven to be timeless by stock market gurus like Benjamin Graham, David Dodd and billionaire Warren Buffet and just to name a few. Though the business and investment landscape has changed tremendously over the years, the timeless wisdom of building wealth with margin of safety approach is still relevant as it was back then when Warren Buffet was in his ninth grade.

Wealth creation is more like scooping up few snowflakes on your hand and packing into snowball. As your snowball grows in size, you pack more snowflakes on and finally give it a push and as it moves, your snowball collects more snowflakes and naturally grows in size.

Snowball here refers to your wealth. How then do you keep adding more snow to your growing snowball? Here is my simple strategy, yet very practical strategy;

My personal wealth creation blue print

Raise capital from earned income (job or business) and investing into passive (real estate) and portfolio (shares) or cash based on the assets underlying values (fundamentals) and hold them for long term for capital gain.

The above concept is succinctly captured by Alice Schroeder in Snowball Warren Buffet and Business of Life. This is the short excerpt.

“It is the winter of Warren’s ninth year. Outside in the yard, he and his little sister, Bertie, are playing in the snow. Warren is catching snowflakes. One time at first. Then he is scooping them up by handfuls. He starts to pack them into a ball. As the snowball grows bigger, he places it on the ground. Slowly it begins to roll. He gives it a push, and it picks up more snow. He pushes the snowball across the lawn, piling snow on snow. Soon he reaches the edge of the yard. After a moment of hesitation, he heads off, rolling the snowball thought the neighborhood”

What are stocks and how does stock market operate?

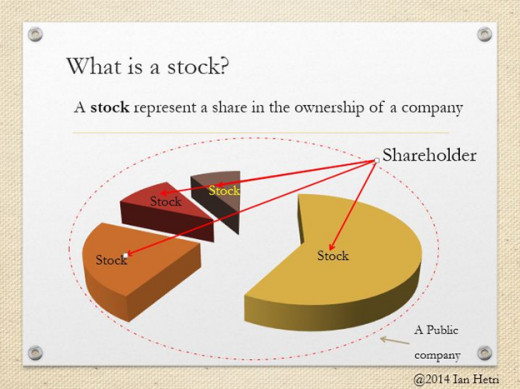

Think of stock market as a big fresh produce market like Gordons market in Port Moresby. At Gordons you and I bring our money and go to the market ourselves and buy kaukau or banana. We present ourselves physically to buy what we want from the sellers. In stock market there is a place call stock exchange where something call SHARES is bought or sold. So what are shares? Shares a basic unit of ownership a company puts out on stock market for investors like you and me to buy and own a piece of that company.

The reason why companies put out shares is because they want to raise capital for their operations. Once we buy their stocks, they use that money to build their business. When they become profitable, then they decide to share their profit with us as shareholders in the form of dividend or capital gain as you share discover soon.

Think of Bank of South Pacific (BSP) as a big pie below. Imagine if we cut that pie (BSP) into million pieces. Each piece is called a share. If you buy some of those pieces (shares), you then become a shareholder of the company whose share or stock you buy.

So where is s share bought or sold?

Now that you understand what a share is, next question you should be asking is where are shares bought or sold.

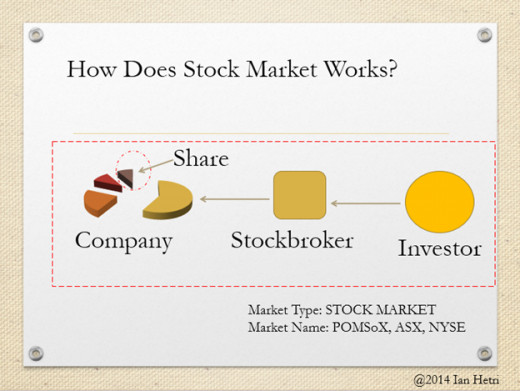

Shares, unlike the fresh produce as we mentioned earlier, are bought and sold in stock exchanges. In the stock market, three main parties take part-Publicly listed companies, stockbrokers and share investors. The publicly listed companies list their shares in the stock exchanges like Port Moresby Stock Exchange. Investors than buy or sell those shares through their stockbrokers. Stockbrokers are the middleman that connect the companies and investors. Detail discussion on stockbrokers will be covered later.

How can you make money on stock market?

There are two ways to make money in stock market;

- Dividend

- Capital gain

Dividend is what the company will pay you if they make profit. However, the decision to pay or not pay dividend lies sorely in the hands of the board of directors of a company.

You realise Capital Gain when you buy a stock at a lower price and the stock price increase over time and you sell the stock at high price. Say for instance, investor John Green buys two stocks of company XYZ in 2002 at a price of K1 per share. That means he has an investment of K2 in company XYZ. Let’s say the stock price increases to K4 per share in 2010. If John sells his share at the price of K4 per share, he realises a capital gain of K4.

Some companies pay dividends, some don’t. Some are growing fast, some not. Some operate globally, others in a single country. Pretty much, any kind of product or service you can think of is represented by a business trading on the stock market. The trick to long-term investing then, is to identify the strongest businesses that are most likely to grow their profits over the next few years. That way, short-term news and market fluctuations don’t matter.

Concluding remarks

Hope you found the article useful. Happy learning and investing.

Did you found the hub useful?

© 2015 Ian Hetri